Bank of the Future

Is Your Infrastructure Ready?

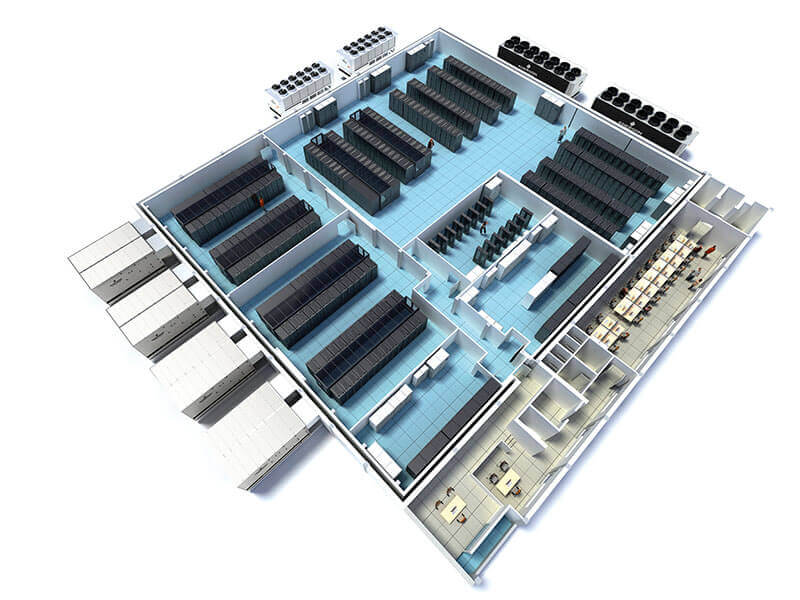

The banking and financial industries are at the forefront of digital innovation. Today it’s all about customer experience. From digital and mobile services to exploring advanced technologies such as the Internet of Things (IoT), primary emphasis is now in removing friction from the customer journey, delivering services that make financial transactions a breeze. To make this happen, you need a robust IT infrastructure that can support your digital initiatives. A holistic approach in power, thermal management and monitoring technologies is essential.

Technology Trends

GIVING YOUR INFRASTRUCTURE THE COMPETITIVE EDGE

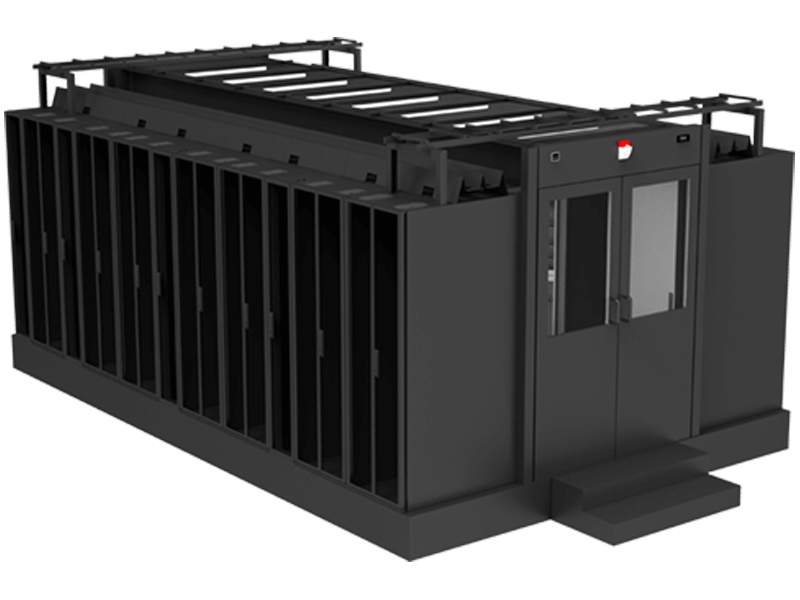

- To provide faster and better services to customers, many banks and now improving their infrastructure at the branch and regional levels. These so-called edge of the network devices bring data and storage closer to the customers, significantly improving the delivery of services. At the same time, with increasing emphasis on data analytics and storage, institutions are banking on their branch offices to handle and process these information faster.

PROTECT YOUR BANKING SYSTEM VS CYBER ATTACKS

- The banking and financial sector is prone to cyber attacks. Hackers and cyber criminals would want to target financial institutions either to retrieve personal information of customers or to demand ransom. In fact, a recent study has shown that the frequency of cyber attacks, ranging from Denial of Service attacks to malware, has increased by as much as 31%, costing an average of $255,000. About 1 in 50 of these attacks can be traced to security failures.

IS YOUR ATM OPERATING AT PEAK EFFICIENCY?

- The ATM is your closest link to your customer as it allows them to do a multitude of transactions without having the need to wait in line for long periods. On average, a bank has about 100-1,000 ATMs in their network, all of which need to be available 24 x 7. ATM outages can greatly inconvenience a customer and are sometimes brought by a chain of failures from system providers.